Planning for later life well-being is essential to meet your needs and preferences as you age. Here are some key steps to consider when planning for later-life care:

- Assess your current situation: Take stock of your current health, financial situation, and support network. Understand any existing medical conditions and how they may progress over time.

- Advance directives: Create advance directives, including a living will and Lasting Powers of Attorney for Finance and Property and Health & Welfare. These documents outline your wishes for medical care and appoint someone to make financial and healthcare decisions on your behalf if you cannot do so.

- Financial planning: Review your financial situation and make plans for covering the costs of long-term care. This may include savings, insurance policies, retirement accounts, and government benefits.

- Long-term care options: Research different long-term care options, such as in-home care, assisted living facilities, or nursing homes. Consider cost, location, quality of care, and services offered.

- Legal and estate planning: Review and update your will, trusts, and other legal documents to ensure your assets are distributed according to your wishes. Consider consulting with an estate planning solicitor to help with this process.

- Support network: Identify friends, family members, and other caregivers who can provide support as you age. Discuss your plans and preferences with them so they understand your wishes and can assist you when needed.

- Healthcare resources: Familiarize yourself with healthcare resources in your area, including doctors, specialists, hospitals, and community support services. Stay proactive about managing your health and seek medical care as needed.

- Stay informed: Stay informed about changes in healthcare laws and policies that may affect your later life care options. Keep up-to-date on new developments in medical technology and treatment options.

- Stay active and engaged: Maintain a healthy lifestyle by staying physically active, eating a balanced diet, and engaging in social activities. Stay connected with friends and family members to prevent isolation and loneliness.

- Review and update your plan: Regularly review and update your later-life care plan as your circumstances change. Be flexible and willing to adjust as needed to ensure your plan meets your needs and preferences.

By planning for later-life care, you can help ensure that you receive the support and assistance you need as you age and that your wishes are respected throughout the process.

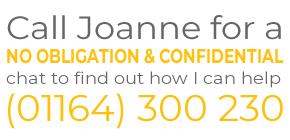

To find a trusted accredited financial advisers who understand financial needs in later life, follow this LINK