Pension Credit is a means-tested benefit in England that provides financial support to eligible individuals or couples who have reached the state pension age.

Pension Credit tops up a person’s income to a minimum of £201.05 per week for single pensioners and to £306.85 for couples, or more if a person has a disability or caring responsibilities.

The Department for Work and Pensions (DWP) estimates that 850,000 pensioner households may be entitled to an average annual income boost of more than £3,500 but do not claim it as they wrongly believe some of the following.

Several myths and misconceptions surround Pension Credit, which can lead to misunderstandings about who is eligible and how it works. Here are some common Pension Credit myths in England:

1. Myth: Everyone automatically receives Pension Credit when they reach the state pension age.

Reality: Pension Credit is not automatic. You must apply for it, even if you already receive the basic state pension. The eligibility criteria are based on your income and savings, so not everyone will qualify.

2. Myth: You can’t work or have any savings to qualify for Pension Credit.

Reality: You can work and still qualify for Pension Credit, but your income and savings must fall below certain thresholds. The amount of Pension Credit you receive depends on your financial circumstances.

3. Myth: Pension Credit is the same as the state pension.

Reality: Pension Credit is a means-tested benefit designed to top up the income of eligible pensioners. On the other hand, the state pension is a regular payment made to individuals who have reached the state pension age, and it is not means-tested.

4. Myth: You can’t get Pension Credit if you own a property.

Reality: Owning a property does not automatically disqualify you from receiving Pension Credit. However, your property’s value may be considered when assessing your overall financial situation.

5. Myth: Pension Credit is a one-time payment.

Reality: Pension Credit is usually paid on a regular basis, either weekly or every four weeks, depending on your preference. It is meant to provide ongoing financial support to eligible individuals or couples.

6. Myth: Pension Credit is only for low-income pensioners.

Reality: Pension Credit primarily aims at low-income pensioners but can also benefit those with modest savings and income. The eligibility criteria consider various factors, including age, income, and savings.

7. Myth: If you receive Pension Credit, you can’t receive other benefits.

Reality: Pension Credit can be received alongside other benefits, such as Housing Benefit, Council Tax Reduction, and Cold Weather Payments. However, receiving Pension Credit may affect the amount of other benefits you’re entitled to.

8. Myth: Your payments will never change once you start receiving Pension Credit.

Reality: The amount of Pension Credit you receive can change over time, depending on changes in your income, savings, and living circumstances. Reporting any changes to the relevant authorities is essential to ensure you receive the correct amount.

To get accurate and up-to-date information about Pension Credit and determine your eligibility, it’s advisable to contact the Department for Work and Pensions (DWP) or consult an independent advisor. Additionally, the rules and regulations surrounding benefits like Pension Credit may change over time, so staying informed is crucial.

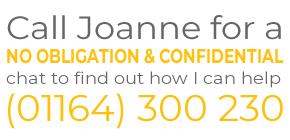

You can contact me in the following ways:

Telephone: 01164 300 239

Email: enquiries@suenriecareadvisers.co.uk

Book a FREE 30-minute call: https://calendly.com/sunrisecareadvisers/free-30-minute-conversation