More than 1.4 million people over state retirement age with care needs receive additional financial support of either £68.10 or £101.75 weekly through Attendance Allowance.

However, for some people whose condition may have worsened or have developed further health issues since their award began, it may be necessary to contact the DWP to report a change of circumstances.

This is something that shouldn’t be put off, as reporting a change in your circumstances could lead to higher payments for those on the lower rate.

Reporting a change if you need more help:

You should consider contacting the DWP to report a change if you feel you need more help for a disability or illness. This could be additional help or supervision throughout the day or at times during the night -even if you do not currently get that help.

You should also consider reporting a change if you are experiencing more difficulties completing personal tasks, for example, if they take you a long time, you experience pain, or you need physical help, like a chair to lean on. But remember, Attendance Allowance is not just for people with a physical disability or illness.

You should also consider reporting a change if you need more help or supervision throughout the day or night and have:

- a mental health condition

- learning difficulties

- a sensory condition – if you are deaf or blind

The most common condition claimed on Attendance Allowance is arthritis (29%), with some 416,313 people receiving support for it.

However, there are more than 50 conditions being supported by Attendance Allowance and even if you’re already claiming for one of these, another may have developed, or your current condition may have become more debilitating.

Support is also provided for People who are terminally ill.

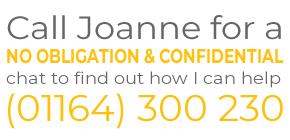

Please contact me for further information on this.

How much could I get on Attendance Allowance?

If you are currently on the lower rate of £68.10 per week, your payments could increase by £33.65 to the higher rate of £101.75. This would see four-weekly payments increase from £272.40 to £407 – a rise of £134.60.

From April 2024, these rates will rise to £72.65 (lower rate) and £108.55 (higher rate) each week. This amounts to either £290.60 or £434.20 every pay period.

Attendance Allowance is a tax-free benefit paid by the Department for Work & Pensions (DWP). It is designed to help older people with daily living expenses, which could help them stay independent in their homes for longer.

You can spend the money however you like to make your life easier.

This might include:

- paying for taxis

- helping towards bills

- paying for a cleaner or gardener

Can I claim Attendance Allowance even if I have savings and other income?

Yes. Attendance Allowance isn’t means-tested, so it doesn’t matter what other money you have coming in or how much you have in savings either – there’s no limit. It is also tax-free, and you will be exempt from the Benefit Cap, so you won’t have money taken away from any other benefits.

Will Attendance Allowance Affect my State Pension?

No, it won’t affect your State Pension, and you can even claim it if you’re still working and earning money.

How does Attendance Allowance affect other benefits?

The other benefits you get might increase if you get Attendance Allowance; these include:

- Extra Pension Credit

- Housing Benefit Reduction

- Council Tax Reduction

N.B. It’s important to be aware that DWP guidance states that if your circumstances change, the amount you get from Attendance Allowance may go up or down.

Recent Posts

- Caring for Our Older Loved Ones During Winter: A Guide for Family Carers

- VAT Relief for Disabled People: A Simple Guide to What You Can Claim and How

- The Rising Cost of Care Homes in England: Who Pays? Check the Small Print

- Understanding Deprivation of Assets in Adult Social Care – There is NO Seven-Year Rule!

- Juggling Work and Caring for a Loved One? You’re Not Alone